Historically, VC (venture capital) fund has been an exclusive doorway for investing in the most exciting deals and startups of the future. Now, individual investors can tap the deals that were out of their reach earlier by grouping through a syndicate or an SPV Investment Fund.

Angel Investors are the lifeblood of a Startup’s growth, always looking to invest in the best. Over the years, with the development of the startup ecosystem, the private market has democratized. An SPV for investor groups is a way to access exciting startup deals, which is one of the most significant advantages of SPVs for angel investors.

SPVs or Special Purpose Vehicles are legal entities created with a special purpose that can vary. In the Startup world, the special purpose is to support and invest in the chosen startup. SPV for investment is used as a fund to deploy capital in a startup on a deal-by-deal basis. The fund, also known as a syndicate, is a clean, instant, and transparent way to raise and deploy capital in a Startup. Investors from different backgrounds come together and pool their capital. The syndicate lead or the manager invites potential investors, reviews profiles of interested investors, and acts as a point of contact between the startup founder and the group of investors

In this blog, we will learn the advantages of SPVs for angel investors and how these tax-positive investment vehicles are the next big thing in Angel Investing.

1. Access to deals

It won’t be wrong to say that investing is an insider’s game. You need to get access to the best to invest in the best. Venture Capitalists spend hours of their week merely screening deals. It is network magic that a profitable deal gains attention in the shortest span of time. The challenge for individual angel investors blocking them from putting their money to work is not the discovery of deals—instead, the incapacity to put a large chunk of money on a single agreement. Most Startups won’t take a $10,000 contribution and stuff their cap table. Not to forget the legal and compliance work that comes with every investment.

This is where the SPV investment structure plays its role in making such exciting deals accessible. When 50 investors come together and invest $10,000 through an SPV, creating a single entry in the cap table, the founder welcomes the contribution and starts taking the investors seriously.

2. Risk Sharing

Startup investment works in a high-risk, high-return phenomenon. Investors stepping into this domain know the risks associated with the startup investment. An SPV investment fund empowers investors to contribute in smaller amounts yet make a more significant contribution. Here, the investors minimize the risk and share the same with fellow investors by making a smaller contribution. Not to forget, if the deal turns out to be good, the Investor reaps the benefit of being associated with a successful startup from its early days and enjoys profitability.

3. Professional Perspective

Every startup founder claims they have decoded an idea that can change the world. It takes fundamental skills and craft to get to the heart of the business deal and evaluate whether it would turn out to be a good investment or not. Investing through an SPV Investment Fund involves a syndicate deal manager and fellow investors.

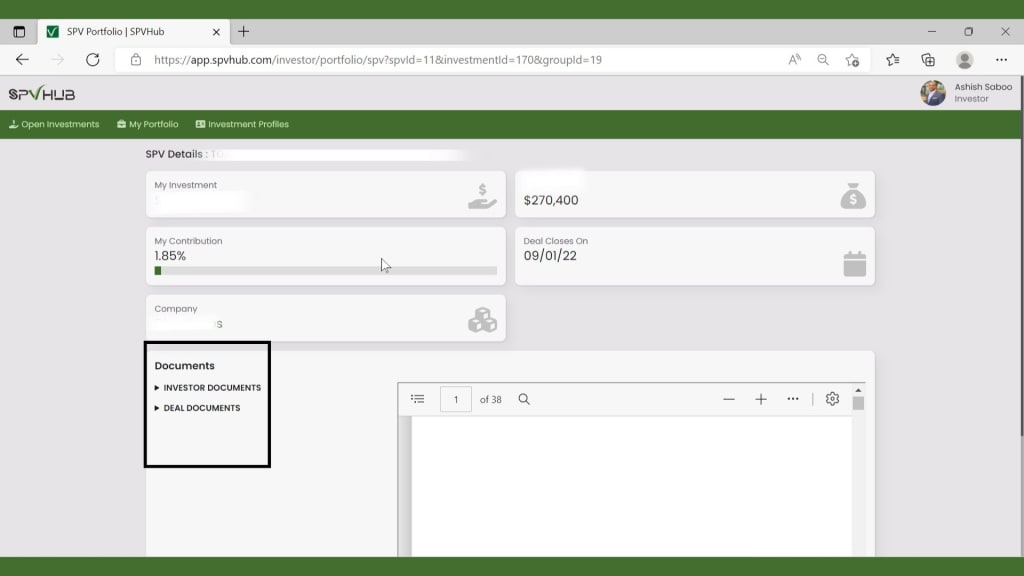

At SPV Hub, we have boosted the advantages of SPVs by creating a solid structured format for uploading the Operating Agreement, Subscription Agreement, and Deal Document. Every crucial element in one place gives a better view of SPV for investment and improves the Investor’s decision-making power.

4. Simplification

Another advantage of SPV – is the elimination of legal complications and complexities. The process of sourcing a deal, screening, and due diligence is a time taking task. Raising and deploying the capital in the absence of the SPV Investment Fund can include multiple legal complications and the involvement of lawyers and compliance officers to stay on good terms with the SEC.

SPV for investment in Startups can make the entire process trouble-free. SPV experts at SPV Hub work with the lawyers and simplify the job for individual investors. Setting up and administration of SPV needs expertise in six domains. The involvement of SPV experts simplifies the process and minimizes it to three steps for angel investors – Commitment, Uploading Documents, and Wiring. Syndicate managers take care of the rest, including K1s and taxation at the end of the year.

5. Diverse Portfolio

If an individual angel investor goes for deploying capital in a Startup at the seed stage, most startups won’t take less than $20,000, which means spending a whole lot of $200,000 on just ten startups (fewer shots). In private investment, especially Startups, the risks are higher. Your investments can go to ZERO within a few years if not diversified strategically. Another advantage of SPV is that it diversifies the portfolio by putting a minimum amount on stake. At SPV Hub, the investment can be as low as $5,000, so if you have $200,000 in your pocket for Startups looking for capital, you can give a shot to 40 startups through SPV for Investment. Double down your winners and increase your possibilities of investing in the next unicorn with an SPV Investment fund.

How can an investor participate in an SPV created at SPV Hub?

Digitization has made our lives better. We can connect with people, no matter how far they are. Things are digital now. Be it buying physical goods or making investments.

SPV Hub has brought startup investment to the palms of investors, making it possible to deploy capital in open investments in just three steps.

SPV for investment is a great way to support a startup and offers multiple advantages for angel investors. Elimination of legal complications is just another reason to start investing with SPVs.

We are here to help! Start your SPV today with SPV Hub.

I’m the Co-Founder of Startup Steroid, where I help founders navigate the challenges of building a startup. From connecting with the right investors and talent to guiding marketing, legal, and MVP development, I work alongside entrepreneurs to provide practical support and clarity, helping them grow their ideas into successful, sustainable businesses.