Angel investors and groups invest millions of dollars in startups every year. Despite the availability of numerous tools, many angel groups still need to rely on spreadsheets or switch between multiple tools to manage their deal flow. Angel groups can benefit from cutting-edge Deal Flow Management Software to streamline deal flow and boost efficiency. However, choosing the right software can take time and effort with so many available options. In this blog, we will discover 11 essential features for selecting a Deal Flow Management Software for your angel group.

Introduction

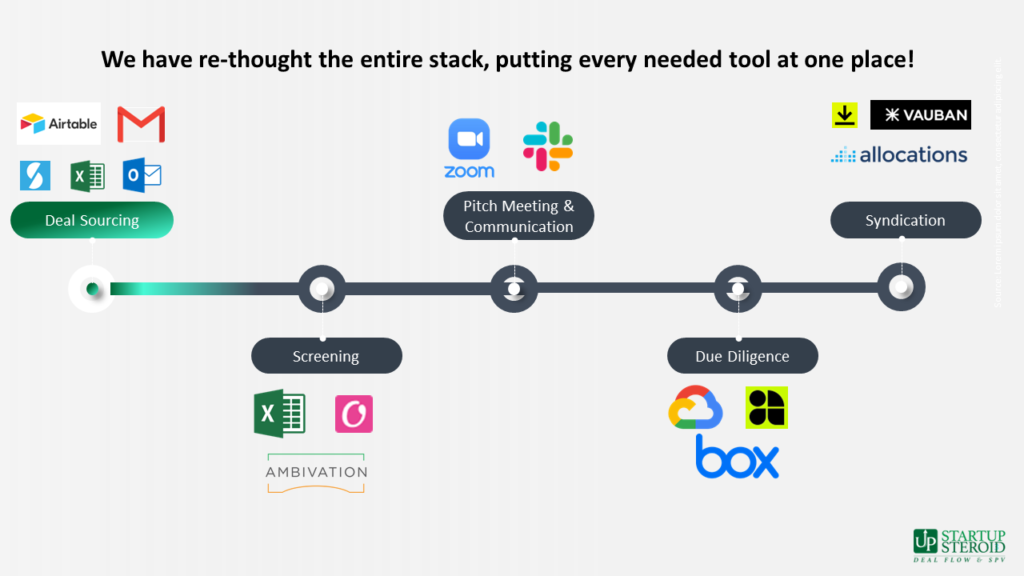

The angel investment market is highly fragmented, with a multitude of tools available for various activities, such as deal sourcing, secure file sharing, and deal syndication. For instance, Airtable is a popular tool for deal sourcing, Box is commonly used for secure file sharing, and platforms like Syndicately facilitate deal syndication. However, this abundance of tools has led to a situation where investors, who are supporters of life-changing startups, are forced to juggle between multiple tabs, which can significantly affect their efficiency and ability to identify the next unicorn startup.

Angel groups must be selective and only invest in startups that fit their investment thesis. To achieve this, they require reliable deal flow management software to streamline their workflow and help them make informed investment decisions. Using suitable deal flow management software, angel groups can significantly enhance their efficiency and increase their chances of identifying the next big thing in the startup world.

What is Deal Flow?

Deal flow is like a steady stream of startup investment opportunities and business deals that come your way as an angel investor. It’s like a river filled with possibilities, and you get to pick the best ones. If you’re an experienced angel investor who knows all about deal flow and its significance, skip right to “Features to look for in a Deal Flow Management System.” But if you’re new to the world of angel investing and want to learn more, keep reading because we’ve got some valuable insights for you!

Imagine you’re searching for precious gems in a river. The river represents opportunities; each gemstone is a potential startup investment or business deal. Some gems are valuable, while others may be less great.

Many entrepreneurs have brilliant ideas for starting new businesses in today’s world. They’re like the main characters in this story. They need support to bring their ideas to life, and that’s where investors like you come in. You have the power to help these entrepreneurs by providing guidance and money.

However, there are many entrepreneurs and only a limited amount of resources. That’s why having a good deal flow management software is crucial. It helps you sort through the river of opportunities efficiently so that you can focus on the most promising gems.

Importance of Deal Flow Management

In the world of startup investing, you can take advantage of opportunities. Every deal that slips through your fingers means a potential loss. That’s where a solid deal flow management platform is handy, helping you spot those game-changing startups that could bring you huge returns.

With a good deal flow management platform, you can cast a wider net and capture many investment opportunities. It gives you access to a curated pipeline of startups so that you can evaluate and choose the most promising ones.

But it’s not just about expanding your reach. This platform also streamlines your investment process, making organizing and evaluating deals easier, conducting due diligence, and making informed decisions.

Features to Look for in a Deal Flow Management System

FEATURE |

DESCRIPTION |

| 1. Angel Group as-a-platform | White label deal flow platform with personalized branding and unique URL to intake startup applications in a systematic way |

| 2. Secure file sharing | End-to-end encrypted data room |

| 3. Centralized Pitch Decks | All the pitch decks neatly organized in one place |

| 4. Dedicated space to share notes | Investors screen a deal and share their input |

| 5. Quick Screening & Filters | Filters based on industry, startup stage, location, and other relevant criteria, investors can quickly scan through the applications |

| 6. Multiple Due Diligence team | Deal-by-deal dedicated teams focused on conducting due diligence, creating detailed checklists, and performing extensive research. |

| 7. Kanban Board | Each deal is represented by a card you can move across the columns as it progresses through the pipeline. |

| 8. Customizable Deal Stages | Create stages that align with your group’s investment criteria and decision-making process |

| 9. Multiple Startup Pools | Keep track on the origin of a startup deal |

| 10. Mobile Accessibility | Screen, create a watchlist, and invest in a startup with a smartphone |

| 11. Integrations | Deal syndication, e-Mail, Chat, and share startup deals through social media platforms |

1. Angel Group-as-a-platform

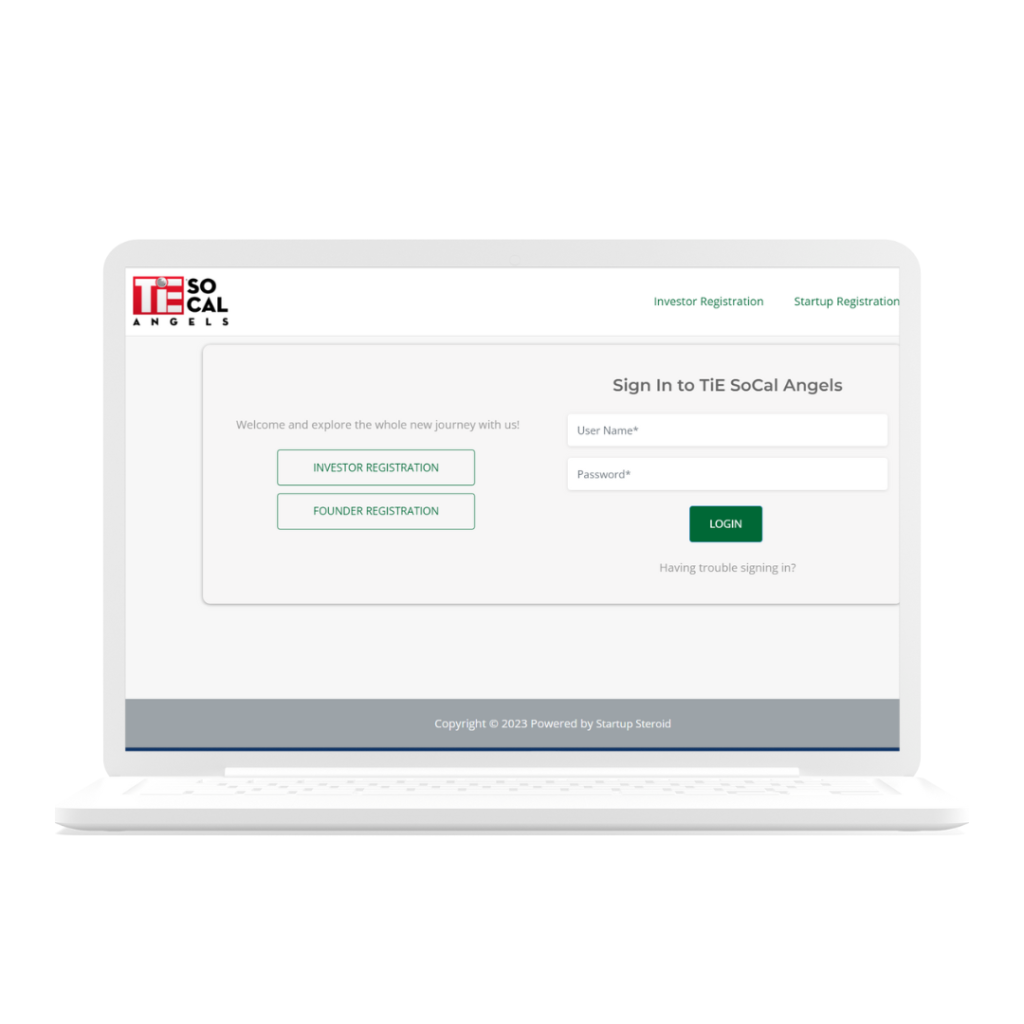

Let’s break down the “what” of this feature before diving into the “why.” Dealing with data entry can be a tedious part of managing a deal flow management software. However, with a white-label deal flow platform, angel groups can leverage their website or a unique URL to collect startup funding applications and enjoy the benefits of direct sourcing with their Angel Group-as-a-platform.

In a white-label platform, organizations can customize an existing deal flow management platform with their branding, logo, and design elements. This creates a personalized and seamless deal flow experience.

Angel groups can add a website button directing visitors, investors, and startups to a registration and login page. Doing this eliminates the hassle of monotonous data entry, as all the applications received will go directly into the system. It functions beyond just a form, as it allows for capturing multiple information points and presents them in a more digestible manner.

This platform feature brings efficiency and convenience to angel groups by streamlining the application intake process. It not only saves time but also offers a more user-friendly experience for investors and startups. Angel Groups can eliminate mundane data entry tasks and take advantage of a more streamlined approach to managing your deal flow.

2. Secure file sharing

In the world of investment deals, angels and startup founders exchange vital information like financials and intellectual property. But here’s the thing: we’re living in a digital age where data breaches are unfortunately all too common. That’s why it’s absolutely crucial to prioritize the security of your data when sharing files and sensitive information.

When choosing a deal flow management software, angels should pay close attention to whether the platform offers a secure data room. This data room acts as a controlled environment where you can securely share and store your essential documents. It ensures that only authorized individuals have access to the information, reducing the risk of unauthorized leaks or breaches.

One key feature to look for in a deal flow management software is end-to-end encryption for the data room. This means that your files and information are encrypted from the moment they’re uploaded to when authorized parties access them. It adds an extra layer of protection to your data, making it significantly harder for any unauthorized person to gain access.

Investing in a platform with a secure data room not only safeguards your sensitive information but also instills trust between investors and startup founders. It demonstrates your commitment to data security and privacy, creating a safe collaboration and due diligence environment.

3. Centralized Pitch Decks

Finding investment opportunities can be a scattered process, and when multiple investors are involved, it becomes even more challenging to keep track of all the open opportunities. Many investors resort to using Google spreadsheets to review deals in real-time, but this method can quickly become overwhelming.

Just imagine the tediousness of creating a new spreadsheet for each deal, uploading pitch decks to Google Drive, and then adding the corresponding links to the spreadsheet. And what if you’re dealing with hundreds of startups? It’s simply too much work to handle efficiently.

That’s where efficient deal flow management software with a centralized pitch deck feature comes to the rescue. Utilizing such software can streamline and simplify your deal flow management process.

With a centralized pitch deck feature, you can have all the pitch decks neatly organized in one place—no more digging through various folders or spreadsheets to find the correct information. Everything is conveniently accessible within the deal flow management software.

Not only does this save you time and effort, but it also ensures you never miss out on any crucial details or opportunities. You can easily review, compare, and evaluate pitch decks without the hassle of switching between different platforms or documents.

4. Dedicated space to share notes

A dedicated space to share notes is crucial when working with a group. In startup investing, every investor on the board must have the opportunity to share their views on the listed deals. Whether in a descriptive or tally format, the ability to exchange information and insights is key. And not just that, all the shared data should be easily accessible to the admin, ensuring transparency and collaboration within the group.

5. Quick Screening & Filters

Managing the data can become overwhelming when an angel group receives numerous startup applications. That’s where a deal flow management system comes in handy. One essential feature that helps make sense of the data is filters.

Investors have their investment preferences, and filters are crucial in streamlining the screening process. By creating filters based on industry, startup stage, location, and other relevant criteria, investors can quickly scan through the applications and identify the ones that align with their interests.

These filters act as a time-saving mechanism, allowing investors to focus on the startups most relevant to their investment goals. Instead of scanning through a massive database, they can narrow down their options and review applications more efficiently.

6. Multiple Due Diligence team

Due diligence is a crucial step in the investment process for angel investors. It involves a thorough investigation and evaluation of a company to determine whether it’s a worthy investment opportunity. Angel groups often have dedicated teams focused on conducting due diligence, creating detailed checklists, and performing extensive research.

Now, when it comes to deal flow management software, it needs to align with the due diligence process. The software should provide features and functionalities enabling angel groups to track and manage their due diligence activities.

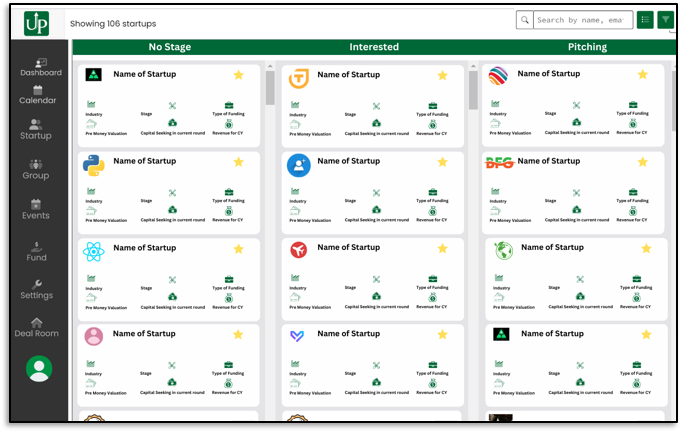

7. Kanban Board

Imagine having a virtual whiteboard that visually represents the different stages of your deals. That’s exactly what a Kanban board does in deal flow management software. It’s a simple yet powerful tool that allows you to easily drag and drop deals from one stage to another, clearly understanding where each deal stands.

Imagine having a virtual whiteboard that visually represents the different stages of your deals. That’s exactly what a Kanban board does in deal flow management software. It’s a simple yet powerful tool that allows you to easily drag and drop deals from one stage to another, clearly understanding where each deal stands.

With a Kanban board, you can visualize your deals in a way that makes sense. You can create columns for different stages, such as “Screening,” “Due Diligence,” and “Closed Deals.” Each deal is represented by a card you can move across the columns as it progresses through the pipeline.

You can quickly identify bottlenecks, see which deals require your attention, and prioritize your actions accordingly. The drag-and-drop functionality adds to the simplicity and ease of use. You can effortlessly move deals from one stage to another, reflecting on their progress in real-time. It’s like moving sticky notes on a physical board but with the added benefits of digital automation and accessibility.

So, if you’re looking for a more intuitive and visual way to manage your deal flow, consider using a deal flow management software with a kanban board feature.

8. Customizable Deal Stages

Deal stages within angel groups can vary significantly. Having control over the environment in your deal flow management is crucial. That’s where Customizable Deal Stages come into play.

Customizable Deal Stages allow you to tailor your deal flow process according to your specific needs and preferences. Instead of adhering to a one-size-fits-all approach, you can create stages that align with your group’s investment criteria and decision-making process.

With this flexibility, you can design deal stages that reflect the unique dynamics of your angel group. Whether you prefer a structured progression from initial screening to due diligence, or you have a more fluid and adaptive approach, Customizable Deal Stages give you the power to set it up just the way you want.

9. Multiple Startup Pools

Understanding the origin of a deal is crucial for investors. Often, deals are sourced through networking events or pitch events organized by angel groups. Here, the pool is the club of Startups that share similar origins. By knowing when and where a deal originated, investors can gain valuable insights for the long term. It helps determine the significance of the source in securing future deals. Additionally, this approach allows for better control over deal visibility.

For instance, 15 investors participated in a pitch event in July. It can be easily managed if you only want to showcase the received applications to those specific 15 investors. This way, you have control over who has access to view the deals, ensuring confidentiality and targeted visibility.

By understanding the source of a deal and managing its visibility, investors can make informed decisions, establish meaningful connections, and foster a more efficient deal flow process.

10. Mobile Accessibility

Smartphone accessibility of deal flow is essential for investors because it allows them to screen conveniently, create watchlists, and invest in startups directly from their mobile devices. With smartphone access, investors can stay connected to the latest investment opportunities wherever they are. Furthermore, smartphone accessibility enables investors to create personalized watchlists of startups that catch their interest. They can track and monitor these startups, staying updated on their progress, news, and any changes in their investment potential. This ensures that investors never miss out on exciting opportunities.

11. Integration

Integration is a crucial aspect to consider when choosing a deal flow management platform. While a platform may offer impressive features, it’s important to ensure it seamlessly integrates with your website, email, and other third-party tools. Here are some key integrations to look for:

- Deal Syndication: Deal evaluation and syndication go hand-in-hand. When you encounter a promising deal as an angel admin, the next step is to set up a Special Purpose Vehicle (SPV) and co-invest with onboarded investors. A platform that collaborates well with a deal syndication platform can greatly simplify this process.

- Emails: Efficient communication is essential in deal flow management. Look for a platform that allows you to have templated replies, making it easier to respond promptly to startups and investors.

- Chat: Real-time conversations can be invaluable for effective collaboration and quick decision-making. A platform that incorporates a chat feature enables seamless communication among stakeholders, fostering efficient deal flow management.

- Shareable on Social Media Platforms: Sharing startups you find interesting with others can expand your network and attract potential investors. A platform allowing you to share startups through links or social media platforms can help increase visibility and engagement.

By prioritizing these integrations, you can enhance the functionality of your deal flow management platform.

About Startup Steroid

The Startup Steroid Deal Flow Management Platform offers a comprehensive set of features designed to enhance your deal-making journey. In addition to the mentioned features, it also includes the Startup Demo Day app, which adds even more convenience to the process.

What sets this platform apart is that it’s built by angel investors themselves. They understand the challenges and pain points you may face, making this software a must-have tool for your angel group.

Remember, no one knows everything. Even the Avengers are stronger when they come together. By bringing your angel group together and leveraging their collective expertise, you can accelerate your deal flow and uncover the next big opportunity.

Ready to experience the power of the most advanced deal flow platform? Book a demo with Startup Steroid and see firsthand how it can revolutionize your deal-making process. Don’t miss out on this opportunity to streamline your operations and unlock the full potential of your angel group.

FAQs

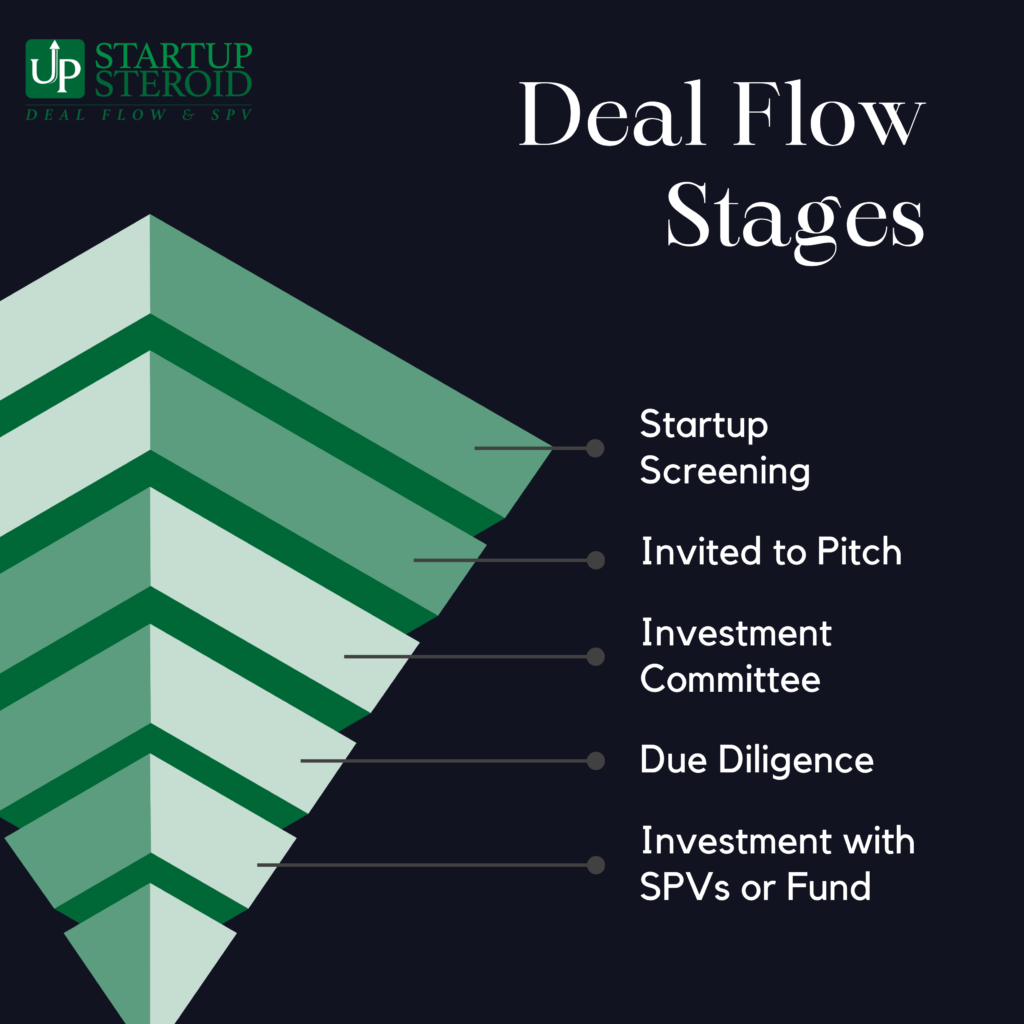

What are the steps in Deal Flow? Deal flow involves several steps:

- Deal sourcing: Finding and gathering potential investment opportunities.

- Deal screening: Evaluating and assessing the viability and potential of each deal.

- Partners review: Collaborating with partners or team members to review and analyze the deals.

- Due diligence: Conducting in-depth research and analysis to validate the information and assess the risks.

- Investment committee: Presenting the deals to an investment committee for further evaluation and decision-making.

- Capital deployment: Once a deal is approved, allocating the necessary capital to make the investment.

What is the deal lifecycle?

The deal lifecycle encompasses the stages from the initial screening to the eventual exit. It begins with the screening phase, where potential deals are evaluated, and it concludes when the investment is exited or sold.

What is Deal Sourcing?

Deal sourcing refers to the process of finding and acquiring potential investment deals. It involves actively seeking out opportunities from various sources, such as networking, industry connections, referrals, or market research.

What is an angel group?

An angel group refers to a collective of individual angel investors who come together to evaluate and invest in startups or early-stage companies. By pooling their resources and expertise, angel groups have greater capacity to support and fund promising ventures.

What are some examples of Deal Flow Management Software?

One notable example of deal flow management software is Startup Steroid, which is recognized as a highly advanced platform in this field. It offers comprehensive features and functionalities to streamline the deal flow process.

What are the benefits of using a Deal Flow Management System for angel investors?

Using a Deal Flow Management System offers several advantages for angel investors, including:

- Streamlined process: It simplifies and organizes the deal flow, making it easier to manage and track investment opportunities.

- Time-saving: The software automates various tasks, reducing manual effort and saving time in deal evaluation and decision-making.

- Better decision-making: Deal flow management systems provide tools and analytics to analyze and compare deals, enabling more informed investment decisions.

What is the difference between deal sourcing and deal screening in the deal flow process?

Deal sourcing involves actively searching and acquiring potential investment deals from various sources. It focuses on finding suitable opportunities. On the other hand, deal screening is the evaluation and assessment of those potential deals to determine their viability, potential returns, and alignment with investment criteria. It involves a more detailed analysis of the deals to make informed decisions on whether to proceed with further due diligence.