isami イサミ ハンドガード

(税込) 送料込み

商品の説明

新品未使用です。

あくまで一度人の手に渡った物です。ご理解のある方のみご検討くださいませ。

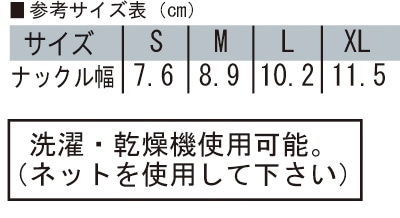

Mサイズ

#isami

#イサミ

#TN-1-BK

#ハンドガード

#拳

#サポーター

#格闘技

#武道

#空手

#キックボクシング

#総合格闘後

#ボクシング

#バンテージ

#格闘技

#総合

#サポーター

#スポーツ

#トランクス

#パンツ

#k-1

#グローブ

#天心

#那須川天心

#RIZIN

#PRIDE

#武尊商品の情報

| カテゴリー | スポーツ・レジャー > その他スポーツ > ボクシング |

|---|---|

| 商品の状態 | 新品、未使用 |

Amazon | ISAMI ハンドガード (ブラック) TN-1-BK //イサミ フル

楽天市場】【ISAMI・イサミ】ハンドガード フルコン用 TN-1(TN1) S/M

Amazon | ISAMI イサミ ハンドガード TN-1 Mサイズ | 防具

ISAMIイサミハンドガードフルコン空手用TN-1 空手 パンチンググローブ

【楽天市場】【ISAMI・イサミ】ハンドガード フルコン用 TN-1

日本未発売 ISAMI イサミ ハンドガード TN-1-BK Mサイズ ienomat.com.br

楽天市場】isami イサミ TN-1 ハンドガード 拳 サポーター 格闘技 武道

ハンドガード | サポーター(手・腕) | 格闘技 武道具用品 格闘技プロ

新作超激得 ヤフオク! - ISAMI イサミ レガース & ハンドガード

Amazon | ISAMI ハンドガード (ブラック) TN-1-BK //イサミ フル

ISAMI・イサミ ハンドガード フルコン用 TN-1(TN1) S/M/L/XL 拳

イサミ ハンドガード ブラック Lサイズ colegio-claridad.com

最新入荷 イサミ ハンドガード グローブ 空手 lifetabupc.com

ISAMI・イサミ ハンドガード フルコン用 TN-1(TN1) S/M/L/XL 拳

ISAMIイサミハンドガードフルコン空手用TN-1 空手 パンチンググローブ

お試し価格!】 ISAMI イサミ ハンドガード TN-1 白 Mサイズ iauoe.edu.ng

SALE/104%OFF】 イサミ ハンドガード Lサイズ ボクシング | www

Amazon | isami イサミ TN-1-BK ハンドガード 拳 サポーター 格闘技

isami イサミ TN-1 ハンドガード 拳 サポーター 格闘技 武道 空手

期間限定特価】 イサミ ハンドガード ブラック Lサイズ ienomat.com.br

ISAMI イサミ ハンドガード フルコン空手用 (M(ナックル幅:8.9cm

高評価の贈り物 ISAMI ハンドガード TN-1 イサミ フルコンタクト空手

ISAMIイサミハンドガードフルコン空手用TN-1 空手 パンチンググローブ

春早割 ISAMI イサミ ハンドガード TN-1-BK 黒 Mサイズ

ISAMI イサミ ハンドガード フルコン空手用 (M(ナックル幅:8.9cm

日本未発売 ISAMI イサミ ハンドガード TN-1-BK Mサイズ ienomat.com.br

isami(イサミ),ヘッドガード | FREEDOM 格闘技用品店 グローブ

ISAMI イサミ ハンドガード フルコン空手用 (M(ナックル幅:8.9cm

楽天市場】【ISAMI イサミ】TN-1 ハンドガード(黒) : イサミ楽天市場店

セール 登場から人気沸騰】 イサミ極真空手 (ISAMI)公式ヘッドギア

Amazon | ISAMI ハンドガード (ブラック) TN-1-BK //イサミ フル

高評価の贈り物 ISAMI ハンドガード TN-1 イサミ フルコンタクト空手

ISAMI・イサミ ハンドガード フルコン用 TN-1(TN1) S/M/L/XL 拳

イサミ ハンドガード Lサイズ - メルカリ

ISAMI イサミ ハンドガード フルコン空手用 (M(ナックル幅:8.9cm

総合福袋 ISAMIイサミハンドガードフルコン空手用TN-1 空手 パンチング

上等なISAMI イサミ ハンドガード フルコン空手用 (M(ナックル幅:8.9

グランドセールグランドセールisami イサミ L-300 ナックルガード 拳

公式】 ISAMI イサミ ハンドガード TN-1-BK 黒 Mサイズ

楽天市場】ISAMI ハンドガード TN-1 //イサミ フルコンタクト空手

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています